Millions of people have used Loans to start and expand businesses, pay for school and cover emergency medical bills. But it’s important to remember that a loan is a financial tool. And like any tool, there are ways to get most out of it. Here are some tips to maximize […]

Loans applications in Kenya are accessed from the Google Play Store by being downloaded into an android mobile phone. They grant instant online loans to applicants. The following is a list of Loans application in Kenya; Tala App It was originally referred to as Mkopo Rahisi. For an applicant to […]

Tala It was introduced in Kenya as ‘Mkopo Rahisi’ in the year 2014. It was later renamed as Tala. For an applicant to procure a loan one requires to have a smartphone and an operating M-pesa. For more information access the; Tala Loan App Saida Loan App Saida uses the […]

The onset of technology has brought about so much ease in accessing funds without having to use the conventional banking and SACCOS for one to have access to money and in particular loans. The availability of smartphones and ease of internet accessibility and customer friendly data packages have made it […]

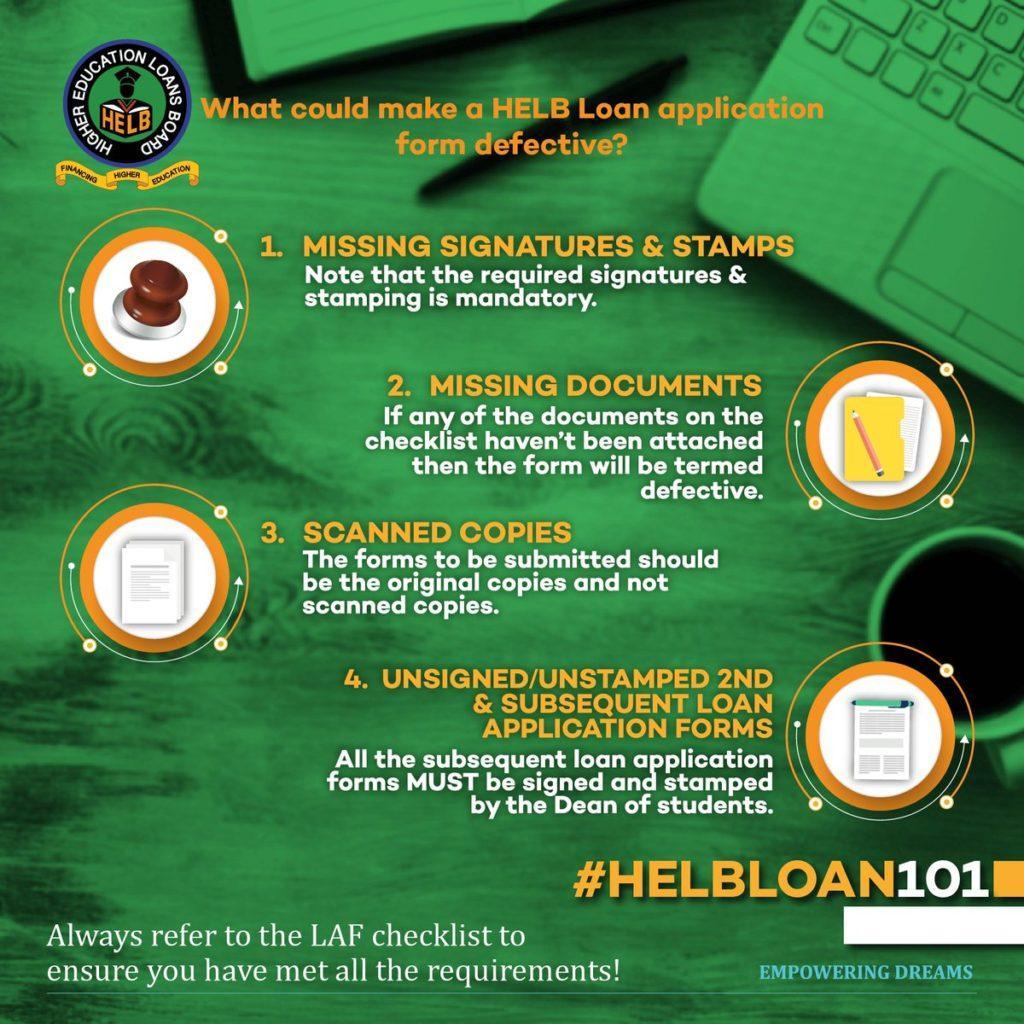

The higher education’s loan board commonly referred to as HELB is an loan disbursement department under the ministry of higher education which is charged with the mandate of providing students with financial assistance so as to make their life in campus more bearable and convenient through meeting the costs incurred while in school.

However, due to the fact that the government is disbursing the HELB to the students.There are a number of conditions which they are supposed to fulfill in order to get the funds, and also for the authorities to prioritize on the neediest students due to the large number of applicants with the loans board. Some of the requirements to qualify for the higher education loan include;

Getting a home loan is a very big commitment as it means that you owe hundred thousand Kenyan shillings to the lender and could take years to repay. Hence, here are some tips that can speed up the process of paying all the money owed back. Choose the right loan […]

Taking a loan in Kenya has been made easy in recent years, but don’t be in a rush to get a loan without carefully considering some major issues that determine whether you repay more or less. Interest rates Most people do put interest rates into consideration when they approach a […]

Acquiring a loan for a small business in Kenya is not an easy task. This is because banks are weary of the risks that small businesses are prone to compared to the large businesses. If you are considering borrowing a loan from a bank for your small business the best […]

If you want to start a small business in Kenya and you are depending on a bank loan for capital, doing research on the bank to get a loan from is a key issue to tackle. Well as you do your own research here are some banks to consider approaching. […]

A bank loan enhances medium or long-term finance. Some kind of security for the loan is a requirement in most cases. Bank loans are very good for financing investments especially fixed assets. The interest charged on a bank loan can be fixed of variable depending on the policies of the […]