TRADE FINANCE National bank of Kenya offers various types of trade finance products to assist customers tender, perform for contracts, expand business activity and provide working capital. Their range of innovative and flexible products & solutions offered are to facilitate international trade and minimize risks, ensuring that your international transactions […]

DHARURA LOAN – School fees loan, Hospitalization, NHIF Contribution Dharura Loan, aka (Emergency Loan) is designed to cater for emergency needs by helping to lighten the burden of unforeseen emergencies like hospitalization and School fees. The repayment period is within 26 to 52 Weeks or 3 to 12 months. The […]

BUSINESS OVERDRAFT The business overdraft is a credit facility whereby a client is allowed by the bank to withdraw funds from his current account up to an agreed negative debit limit. The target Market is SME customers in manufacturing, trade and services including private limited companies, sole proprietors, self-employed individuals […]

TINGG Discover Tingg, an integrated hub of digital services that powers commerce and end to end payments within ecosystems. They provide simple access to fast, secure and cost friendly payment and commerce services for blue chip companies, fast moving consumer goods companies, SMES, consumers – banked and unbanked, corporate and […]

Tala It was introduced in Kenya as ‘Mkopo Rahisi’ in the year 2014. It was later renamed as Tala. For an applicant to procure a loan one requires to have a smartphone and an operating M-pesa. For more information access the; Tala Loan App Saida Loan App Saida uses the […]

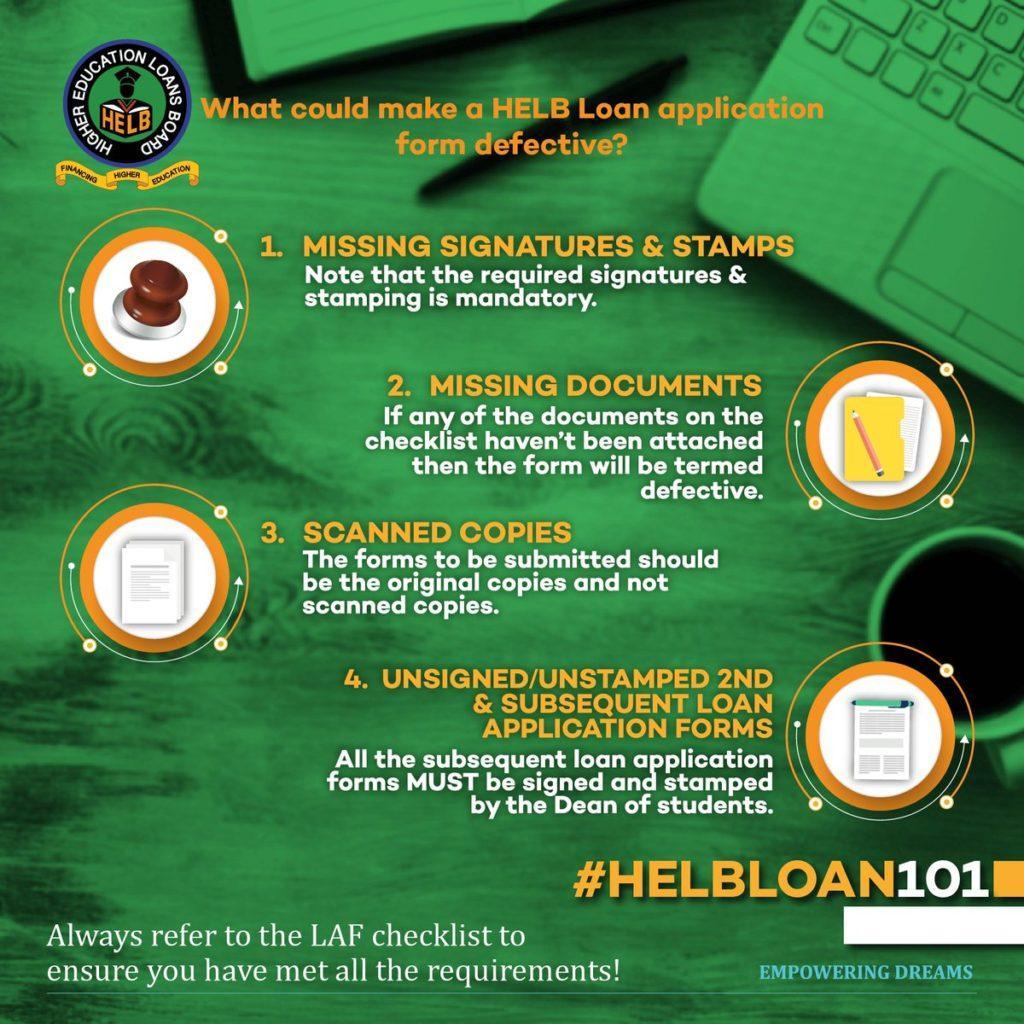

The higher education’s loan board commonly referred to as HELB is an loan disbursement department under the ministry of higher education which is charged with the mandate of providing students with financial assistance so as to make their life in campus more bearable and convenient through meeting the costs incurred while in school.

However, due to the fact that the government is disbursing the HELB to the students.There are a number of conditions which they are supposed to fulfill in order to get the funds, and also for the authorities to prioritize on the neediest students due to the large number of applicants with the loans board. Some of the requirements to qualify for the higher education loan include;

Ever since the financial institutions like Saccos, Banks, HELB and MPESA started forwarding lists of defaulters on CRB, the need for your name to cleared and hence improve your chances of getting a second loan have risen. Clearing your debt is no longer enough as you have to get CRB […]

Getting a home loan is a very big commitment as it means that you owe hundred thousand Kenyan shillings to the lender and could take years to repay. Hence, here are some tips that can speed up the process of paying all the money owed back. Choose the right loan […]

Taking a loan in Kenya has been made easy in recent years, but don’t be in a rush to get a loan without carefully considering some major issues that determine whether you repay more or less. Interest rates Most people do put interest rates into consideration when they approach a […]

Acquiring a loan for a small business in Kenya is not an easy task. This is because banks are weary of the risks that small businesses are prone to compared to the large businesses. If you are considering borrowing a loan from a bank for your small business the best […]