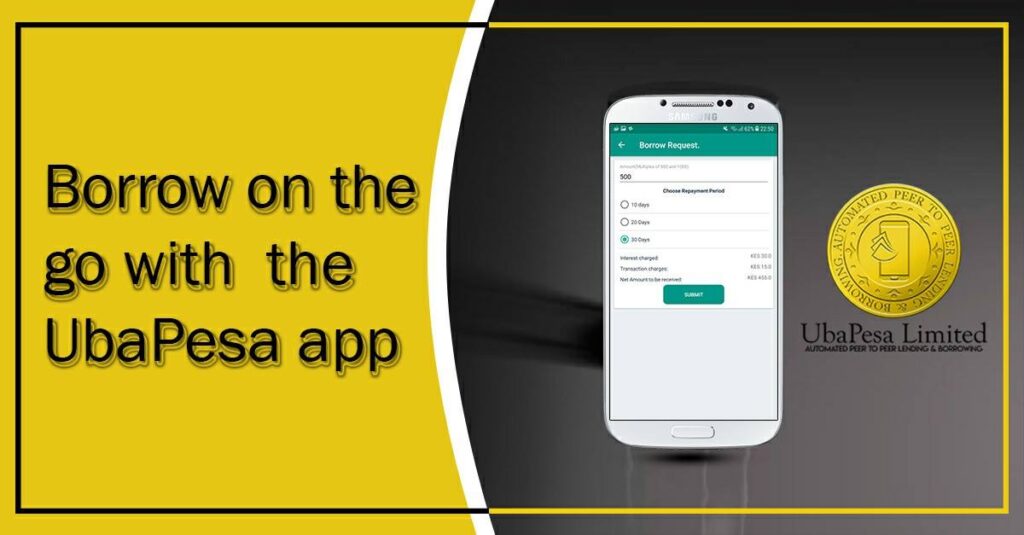

How to get a Loan from Uba Pesa

Uba Pesa Loan offers loans ranging from Ksh 500 to Ksh 50,000 with a flexible repayment period of 61 to 90 days. Approvals are instant, and interest rates reach a maximum 15% from the 14th day. To check your limit and apply, download the app here. Loans are unsecured, making the process hassle-free.

Disbursement Details:

How to Access/Register for the Loan

Desktop screenshot of Uba Pesa App in Play Store

To access Uba Pesa Loan:

- Download the Uba Pesa app from the Google Play Store.

- Register using your M-Pesa number and create a PIN.

- Get approved and receive the loan directly to your mobile wallet.

How to Apply for the Loan

- Open the Uba Pesa app.

- Log in with your phone number and PIN.

- Check your loan limit on the dashboard.

- Enter the desired loan amount and select the repayment period.

- Submit your application.

- Receive approval instantly and get funds disbursed to your M-Pesa.

Total Cost Breakdown (Loan Fees):

- Processing Fee: 2% of the loan amount.

- Loan Facilitation/Access Fee: 10%.

- Interest Rate: Applicable from the 14th day up to the 60th day, up to a maximum of 15%.

- Insurance: 1% of the loan amount.

- Withdrawal Fee: As per M-pesa charges.

- Late Payment Penalty: 10% of the overdue amount, charged on the 65th day.

- No more interest ischarged after the 60th day.

- No more fees or penalties will becharged after the 90th day.

Repayment Details:

Repaying your Uba Pesa Loan is simple and flexible. Repayments are due within 61 to 90 days and can be made in multiple installments or a single installment based on your capacity. Early repayment is allowed with no penalties and can improve your credit limit. You can repay through:

- Mobile money transfer (e.g., M-Pesa).

- Bank transfer via Uba Pesa app.

Eligibility Requirements:

To qualify for a Uba Pesa Loan, you must:

- Be a Kenyan citizen.

- Be at least 18 years old.

- Have a valid national ID.

- Own a registered mobile number.

- Have a regular income source.

Representative Example of Loan Costs

Here’s a breakdown of the costs associated with a Branch loan:

| Loan Amount | Loan Cost (Fees + Interest) | Total Amount to Repay |

|---|---|---|

| Ksh 1,000 | Ksh 250 | Ksh 1,150 |

| Ksh 5,000 | Ksh 1,250 | Ksh 6,250 |

| Ksh 10,000 | Ksh 2,500 | Ksh 12,500 |

Example Breakdown for Ksh 1,000 Loan:

- Borrowed Amount: Ksh 1,000

- Repayment Period: 61–90 days

- Access Fee: 10% (Ksh 100)

- Interest Rate: 15% (Ksh 150)

- Net Amount: Ksh 885

- Total to Pay: Ksh 1,150

- APR: 90% (not applicable as the maximum period is 90 days)

Alternative Lenders to Consider

| Alternative Mobile Loans Apps | Loan Name | Read more about loan |

|---|---|---|

| Senti Loan App | Read more | |

| Berry Loan App | Read more | |

| Okolea Loan App | Read more | |

| Pesa Pata Loan App | Read more |