How to get a loan from Branch Loan App

Branch Loan App offers quick loans ranging from Ksh 500 to Ksh 300,000 with flexible repayment periods, typically between one and 12 weeks. Approval for loans is instant, and interest rates are competitive, ensuring you get the funds you need when you need them. Loans are unsecured, simplifying the process.

Disbursement Details:

How to Access/Register for the Loan

Desktop screenshot of Branch Loan App in Play Store

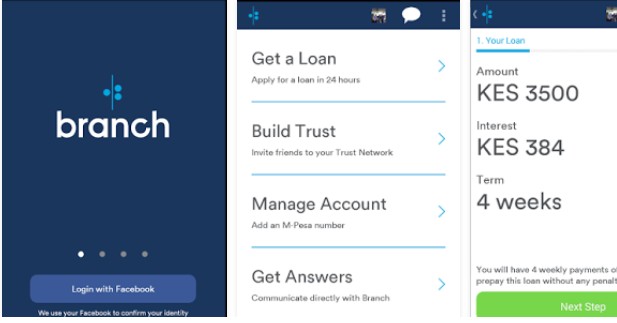

Accessing Branch Loan App is easy:

- Download the Branch app from Google Play Store.

- Create an account with your phone number, Facebook account, National ID, and mobile money account.

- Grant access to the data on your phone to determine your eligibility.

How to Apply for the Loan

Applying for a loan is simple:

- Download the Branch app.

- Sign up and navigate to the “Loans” option at the bottom of the home screen.

- Fill in your personal details, phone number, and mobile money account details.

- View available loan offers, select an option, and tap “Apply”

Total Cost Breakdown (Loan Fees):

- Interest Rate: 17%–35% of the loan amount

- Equivalent Monthly Interest: 1.7%–17.6%

- Insurance: None

- Late Payment Penalty: None.

- Withdrawal Fee: As per M-pesa charges.

Repayment Details:

Branch loan app strongly encourages you to repay your loan according to your “Repayment Schedule”, which can be found by tapping the “Loans” option at the bottom of the Home screen.

To make a repayment, follow these steps:

- Navigate to MPesa in your Safaricom menu on your phone.

- Select Lipa na M-PESA.

- Choose the Paybill option.

- Enter the Paybill number 998608.

- For the account number, enter your M-Pesa number on which you received your Branch loan.

- Enter your repayment amount.

- Enter your M-PESA pin.

- Confirm that all details are correct and press ‘OK’

Eligibility Requirements:

To qualify for a Branch loan, you need:

- Your phone number or Facebook account.

- National ID.

- Mobile money account.

- Grant access to the data on your phone to determine eligibility.

Representative Example of Loan Costs

Here’s a breakdown of the costs associated with a Branch loan:

| Loan Amount | Loan Cost (17% Interest) | Total Amount to Repay |

|---|---|---|

| Ksh 1,000 | Ksh 170 | Ksh 1,170 |

| Ksh 5,000 | Ksh 850 | Ksh 5,850 |

| Ksh 10,000 | Ksh 1,700 | Ksh 11,700 |

Advantages and Disadvantages:

Advantages

- It eliminates the challenge of getting a loan by using data on your phone including your M-pesa SMS history to verify your identity and create a credit score.

- They encrypt the data you choose to share with them to protect your privacy.

- Their fees are clear and easy to understand.

- Their terms allow for easy repayment.

- They do not charge late fees or rollover fees.

- The more you use Branch, the better it gets. Their loan increment eligibility is according to your repayment behavior. Meaning as you pay back on time, their fees decreases, and you unlock larger loans with more flexible terms. Once you complete your application and you qualify for a loan you get it in a matter of minutes.

Disadvantages:

Branch has also got some disadvantages;

- Loan default penalty is decrease in the Branch credit score, inability to get larger loan amounts, loan denial for 7 days or longer, report to the CRB.

- Their loan repayment period is also very short and unfavorable for those who need time to be able to repay the loan. As a first time borrower you may not be able to calculate your loan interest as it depends on your creditworthiness which can be very high till you can create a good credit score.

Alternative Lenders to Consider

| Alternative Mobile Loans Apps | Loan Name | Read more about loan |

|---|---|---|

| Senti Loan App | Read more | |

| Berry Loan App | Read more | |

| Okolea Loan App | Read more | |

| Pesa Pata Loan App | Read more |

Branch Loan App stands out as a reliable and efficient way to access funds quickly. Whether you’re facing an emergency or need extra cash for personal reasons, Branch Loan App has got you covered. Branch loans are quite recommendable for customers who need micro loans urgently and can make their terms of payments. Customers who need larger loans need to check out other institutions that are quite capable of providing such. Branch prides itself in providing funds you need to attain your goals and hence a good option when it comes to borrowing small loans.