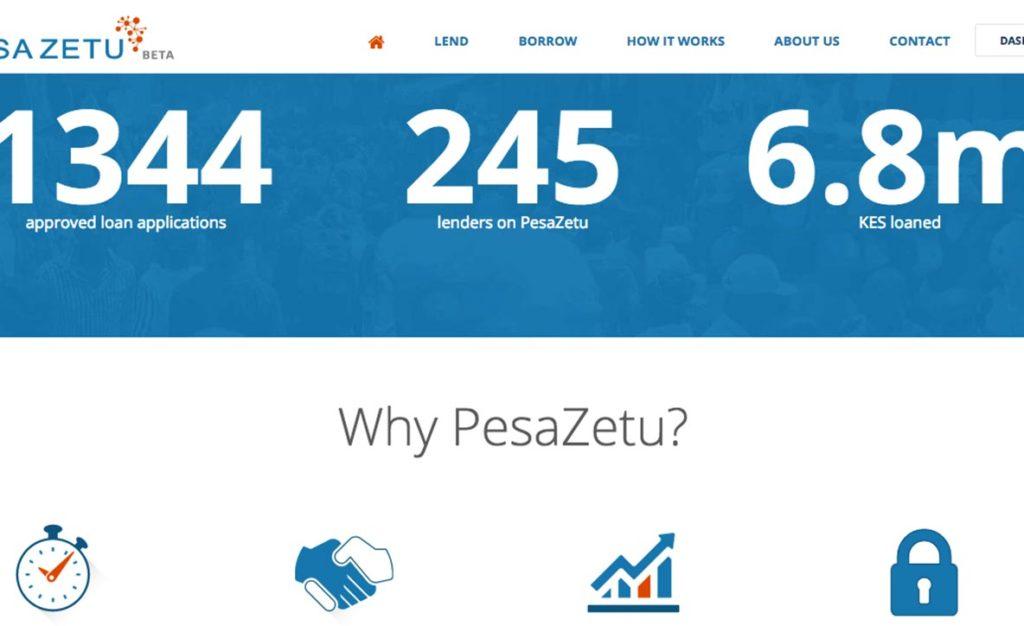

Pesa Zetu Peer to Peer Lending Platform

Pesa Zetu Peer to Peer Lending Platform

Pesa Zetu is an online loan application which has its market base in Kenya, the online application, the model being used by the firm is the peer to peer model whereby the members refer their peers to the application for funds to carry out their various projects. The interest rates being offered by the firm are determined by the market forces and in conjunction with the available opportunities. The other key features about Pesa Zetu is that, one get to post their reason for the loan and the lenders get to assess and those who feel that the loan is a viable opportunity with the ability of paying back the loan.

For one to access the loans being offered by the firm, they have to register with Pesa Zetu website that is www.pesazetu.co whereby they follow the requirements of identifying themselves and their documents to authentic the genuineness of the loan. Upon making the application one then describes their loan, the reason for making the loan and the viability of the business idea which is being funded. Upon assessment, the funds then get disbursed in the account and withdrawn through the M-Pesa account. In addition, to that, the more one pays back the loan and on time they get to qualify for more funds.On the other hand, the lenders tend to follow up on the progress of the funds lent to the borrowers through registering at www.pesazetu.co and they earn interest on the loan offered to the borrowers. With time they can withdraw the money offered after it has been loaned out or they can get withdrawThe features of the loans offered to the clients do have an interest range of between six to 10 percent per month, in terms of duration of paying back the loans being offered they have a duration of twenty eight days to payback the funds, interesting to note is that delay in paying back the loan attracts an interest of up to ten percent.

Advantages of having to borrow with Pesa Zetu;More than one potential investors can fund the project and thus make the funds available to the borrower thus increasing the funds in the company.Upon paying regularly and meeting the deadline one gets to increase their credit worthiness and thus borrow more funds from the firm and attains their financial objectives.Fair interest charges on the loans being borrowed to pay the money borrowed, this enables the borrowers to be in a position to profit from their investments. This makes the firm a preference and attracts more borrowers.Disadvantages of borrowing money with Pesa Zetu;A short period of having to repay the loan in comparison to other lending firms which have a longer duration and more flexible.High interest rates on the loan due to the freedom given to those who are offering the funds to the borrowers.High penalties on late repayment of the funds borrowed especially on business loans.Limited options of loans being offered by the firm.Long time taken in replying to the application being made to the company’s website.